US Tariffs Hit 104% on China: Is Your Underwear Sourcing Strategy Protected?

Feeling the intense pressure from the staggering new US tariffs on your Chinese underwear imports? Are shrinking profit margins, mounting pricing challenges, and pervasive uncertainty clouding your business plans? It's absolutely critical to protect your brand now with a smarter, more resilient sourcing strategy.

Yes, the combined US tariffs on many Chinese goods, including underwear, have skyrocketed in 2025, reaching an astonishing 104% as of April 10th. Protecting your profits now demands exploring diversified sourcing options, particularly a well-managed China + Bangladesh model.

The recent headlines about escalating trade tensions are not just abstract news; they represent a direct and severe financial hit to your bottom line, especially if you rely heavily on China for your underwear production. Understanding the full gravity of this situation is the essential first step toward finding a viable solution. Let's break down exactly what these unprecedented tariffs mean for your business and explore how you can navigate this incredibly challenging environment without sacrificing the quality or competitiveness your brand depends on. Staying informed and highly adaptable is no longer optional—it's the key to survival in this storm.

Just How High Are US Tariffs on Chinese Underwear Now?

Confused and alarmed by the sheer scale of the tariff costs hitting your Chinese underwear shipments? Are unexpected, massive duties destroying your profits and making budgeting seem impossible? Let's clarify the current, harsh tariff reality and its devastating impact on your landed costs.

As of April 2025, total US duties on Chinese underwear combine base rates (~16%) with various punitive layers, culminating in a reported 104% total tariff effective April 10th. This makes diversification away from China not just strategic, but essential for US market viability.

Understanding the multiple layers crushing your import costs is absolutely crucial. It's not a single tariff causing the pain; it's a cascade of duties creating an immense financial burden. First, you have the standard base tariff rate for underwear, typically around 16-17% for common HTS codes like 6108 (knit panties) or 6212 (bras). On top of this, the US implemented Section 301 tariffs targeting Chinese goods years ago, often adding 7.5% or 25%.

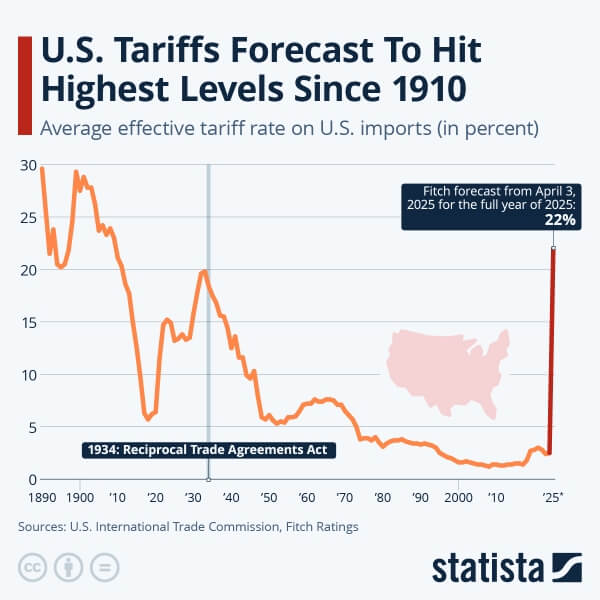

However, 2025 brought dramatic and unprecedented escalations. Following earlier increases, the situation culminated in reports that tariffs on Chinese goods would rise to at least 104% effective Wednesday, April 10th, 2025. This figure represents a shocking jump from previous levels and fundamentally alters the landed cost calculation, making China prohibitively expensive for many US imports.

Let's revisit our cost example for a women's nylon panty 5-pack to see the stark reality of these us tariffs on china 2025. The previous analysis showed savings with Bangladesh by avoiding a 27.5% punitive tariff. Now, with the total effective current tariffs on china hitting 111.5%, the difference is astronomical. While the basic FOB cost might be slightly higher in Bangladesh, the tariff impact completely dominates the final landed cost.

| Cost Component | China (USD - Est. April 2025) | Bangladesh (USD - Est. April 2025) | Landed Cost Difference |

|---|---|---|---|

| Raw Materials | $2.00 | $2.30 (+15%) | |

| Labor | $1.00 | $1.00 (0%) | |

| Overhead & Other | $2.00 | $2.00 (0%) | |

| Total FOB Cost | $5.00 | $5.30 (+6%) | |

| Base Tariff (~15.6%) | $0.78 | $0.8268 | |

| Additional Tariffs (Sec 301 + 2025 Layers) | ~$5.575 | $1.961 | |

| Estimated Total Landed Cost | ~$11.355 | ~$8.0878 | ~28.77% Savings for Bangladesh |

The compounding effect of these multiple us tariffs on China means the landed cost advantage for sourcing underwear tariffs in a country like Bangladesh (which primarily faces only the base tariff) widens dramatically to around 40%. This transforms diversification from a strategic option into an urgent necessity for maintaining any semblance of competitive pricing in the US market.

Is Betting Everything on One Country Too Risky in 2025?

Does relying solely on one country for all your production feel increasingly unstable and dangerous? Are you worried about sudden policy shifts, crippling port delays, or unexpected labor issues completely disrupting your supply chain? Diversifying your sourcing isn't just smart anymore; it's absolutely essential for survival.

Absolutely. Concentrating lingerie production in any single country—China, Vietnam, Bangladesh, or Cambodia—carries extreme risks in 2025. These include crippling tariffs, geopolitical instability, labor disruptions, and logistical nightmares. Diversification is the only reliable key to mitigating these vulnerabilities and ensuring supply chain resilience.

The global trade environment is more volatile and unpredictable now than at any point in recent memory. Placing all your production bets on a single country, even a manufacturing powerhouse like China, feels like playing Russian roulette with your business. We've all witnessed how quickly political decisions or unforeseen events can shatter supply chains.

The risks associated with single-country sourcing are multiplying rapidly:

- China: The primary, overwhelming concern is the astronomical and volatile US tariff situation (104% and potentially subject to negotiation). Added to this are ongoing geopolitical frictions and rising labor costs.

- Vietnam: Once the favored alternative, it now faces its own steep US tariff increases, reportedly reaching 46% , significantly eroding its cost appeal. Transshipment concerns also linger.

- Bangladesh: Offers compelling US tariff advantages and very competitive labor costs. However, it faces challenges like political instability, periodic labor unrest, infrastructure limitations (though improving), and reliance on imported raw materials.

- Cambodia: Another option, but now faces potentially crippling new US tariffs (reports mention up to 49%) and generally has less capacity and potentially higher labor costs than Bangladesh.

The critical takeaway here is that significant risk isn't confined to China anymore; it's spread across the major sourcing hubs in different, dangerous forms. Simply shifting all production from China to Vietnam or another single location doesn't eliminate risk; it merely trades one set of potentially catastrophic problems for another. This stark reality makes a diversified, portfolio-based approach to sourcing far more robust and necessary than relying on any single location.

| Country | Key Benefits | Key Risks (April 2025 Focus) |

|---|---|---|

| China | Mature infrastructure, high efficiency, skilled workforce, strong raw material base, advanced capabilities. | Extreme & volatile US tariffs (104%), geopolitical tensions, rising labor costs, trade practice scrutiny. |

| Vietnam | Established alternative, good infrastructure, growing capability. | Significant new US tariffs (46%), rising costs, potential "middleman" scrutiny. |

| Bangladesh | Significant US tariff advantage (vs. China/VN), very low labor costs, large RMG capacity. | Political instability/labor unrest risks, infrastructure challenges, compliance risks, raw material import reliance. |

| Cambodia | Lower labor costs (historically), established basic garment production. | Potential crippling new US tariffs (49%), smaller capacity/infrastructure, rising labor costs. |

Why Does a China + Bangladesh Strategy Make Sense for Lingerie?

Do you need drastically lower landed costs without sacrificing the innovation or quality your brand stands for? Are you struggling to balance intense cost pressures with the need for sophisticated materials and cutting-edge design? Combining the unique strengths of China and Bangladesh offers the best path forward.

A China + Bangladesh strategy leverages China's unparalleled strengths in advanced materials, R&D, and complex components, while utilizing Bangladesh's low labor costs and crucial US tariff advantages. This blend optimizes cost, quality, and innovation specifically for lingerie production.

Given that relying on any single country presents unacceptable risks, what's a practical and effective path forward, especially for complex products like lingerie? From my extensive experience managing operations in both regions, I strongly advocate for a "China + Bangladesh" hybrid strategy. It's about intelligently combining the unique advantages each location offers to create a more resilient, flexible, and cost-effective supply chain.

China remains the leader in areas like advanced fabric development, sourcing intricate trims and accessories, and pioneering complex manufacturing techniques. Its R&D capabilities and established ecosystem for high-value inputs are difficult to replicate quickly elsewhere. Bangladesh, conversely, excels with its highly competitive labor costs and, critically for the US market, its much lower tariff barriers compared to China and now even Vietnam. It also boasts immense capacity for garment assembly.

By strategically using China for developing and producing the specialized materials or components that define your product's quality and innovation, and then utilizing Bangladesh for the labor-intensive final assembly, you can achieve a significantly lower total landed cost without compromising the sophisticated elements your brand is known for. This "China-plus-one" approach isn't just about geography; it's about optimizing function and mitigating risk.

This is precisely the integrated model we've perfected at HAVING. With our deep roots and operational factories in both China and Bangladesh, we manage this cross-border production flow seamlessly for our clients. What truly sets us apart is our significant investment in bringing advanced technologies to our Bangladesh facility. We have developed strong, proven capabilities in producing bonded and seamless garments in Bangladesh – techniques still relatively uncommon in that market. This means you don't have to choose between Bangladesh's cost/tariff advantages and the modern construction methods (like seamless knitting or bonded finishes) essential for contemporary lingerie, shapewear, and activewear. Our bonded products manufactured in Bangladesh, in particular, offer a powerful competitive advantage right now, combining sophisticated finishing with substantial cost savings.

| Production Stage / Function | Primary Location | Key Benefit | HAVING's Capability |

|---|---|---|---|

| Research & Development (R&D) | China | Access to innovation, trends, advanced concepts | Strong R&D team in China |

| Advanced/Specialty Raw Materials & Components Sourcing/Production | China | Wider availability, quality control, technical expertise | Established material sourcing network |

| High-Volume Assembly / Cut-Make-Trim (CMT) | Bangladesh | Lower labor costs, US tariff savings (~40% vs China) | Efficient, high-capacity production lines |

| Specialized Production (Bonded, Seamless) | Bangladesh (HAVING Specific) | Combines cost savings with advanced techniques | **Unique capability in bonded/seamless in BD factory** |

| Quality Control | Both (Integrated System) | Consistent standards across locations | Unified QC system, staff rotation |

What If the Trade Winds Shift Again? Planning for Uncertainty?

Are you worried that today's sourcing solution could become tomorrow's costly problem? Hesitant to commit to new partnerships when unpredictable trade policies could change everything again? Build true resilience with partners prepared for multiple future scenarios.

Future trade policies remain highly uncertain. Whether the extreme tariffs on China persist, decrease, or shift elsewhere, global demand for underwear continues. A flexible, stable partner like HAVING, with strong operational footing in both China and Bangladesh, provides essential stability and options regardless of future policy changes.

One of the most challenging aspects of managing a global supply chain today is the relentless uncertainty. What happens if the political climate shifts and those crippling 104% tariffs on Chinese goods are suddenly rolled back? Or what if tariffs unexpectedly spike for imports from Bangladesh or Vietnam? It feels like trying to hit a target that refuses to stand still.

Let's consider the main possibilities:

- High China Tariffs Persist: If the current extreme

us tariffs on Chinaremain, the China + Bangladesh model is clearly the most effective strategy for managing landed costs. In this scenario, suppliers solely reliant on China will likely face severe difficulties or exit the market, potentially creating opportunities for stable, diversified manufacturers like us. - China Tariffs Decrease Significantly: If tariffs on China are substantially reduced, China obviously becomes more cost-competitive again on paper. However, the massive disruption caused by the high tariffs will likely have already pushed many brands to permanently diversify their sourcing base. The market will eventually find a new equilibrium.

In either scenario, companies that have already built relationships with flexible partners – those offering strong, established production options in both China and alternative locations like Bangladesh – will be in the strongest position. They can quickly adjust their production allocation between regions to optimize for the new conditions, avoiding the painful and time-consuming process of finding and vetting entirely new suppliers from scratch.

Regardless of how underwear tariffs fluctuate, one fundamental truth remains: people will continue to buy lingerie. Global demand isn't vanishing. A new equilibrium of pricing and supply chains will inevitably emerge. The key to navigating this uncertain future is partnering with suppliers who offer inherent stability and strategic options.

Even if your long-term plan involves potentially shifting more production back to China if conditions dramatically improve, having established a reliable, high-capability secondary source in Bangladesh provides invaluable backup, flexibility, and negotiating leverage. This built-in adaptability is precisely why partnering with HAVING offers genuine peace of mind. Because we have robust, well-established, and technologically advanced operations in both China and Bangladesh, we provide unparalleled flexibility. We can work with you to strategically shift production volumes between our facilities based on changing tariffs, costs, or your specific product needs.

Think of us not just as a solution for today's tariff crisis, but as a long-term strategic partner built for resilience, ready to adapt and thrive alongside you. Starting a conversation with us now, even if initially just exploring backup options or planning for future contingencies, is a proactive and prudent step towards securing your supply chain stability for whatever the future holds.

Conclusion

The extreme 2025 US tariffs demand immediate, decisive action. Diversifying with a strategic China + Bangladesh approach, especially with an experienced partner like HAVING offering advanced capabilities (like bonded/seamless) in both locations, is the most effective way to protect your profits and ensure future resilience in the volatile global market.