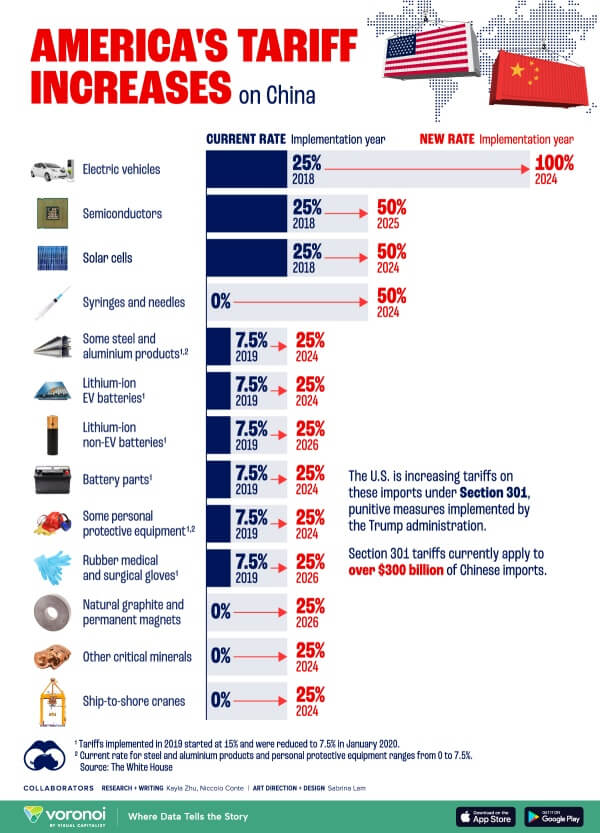

Rising tariffs have thrown the underwear industry into chaos. With Trump's April 2025 announcement of a staggering 104% tariff on Chinese imports and targeted duties on other countries, manufacturers and brands are scrambling to adapt. The financial impact is immediate and severe, threatening margins and competitive pricing across the board.

The most resilient strategy combines China's technical expertise with Southeast Asian production advantages. This dual-location approach balances China's superior materials and R&D with Bangladesh's 28% landed cost savings from avoiding punitive tariffs, creating a flexible supply chain that can adapt to policy shifts.

As someone managing manufacturing facilities in both China and Bangladesh, I've witnessed firsthand how these tariff changes are reshaping the underwear industry. The April 8th announcement of tripling tariffs to 90% on Chinese de minimis packages (used by retailers like Shein and Temu) signals just how serious this administration is about its protectionist agenda. Let me share what I've learned about creating a resilient manufacturing strategy in this volatile environment.

Why Is a Single-Country Manufacturing Strategy Increasingly Risky in 2025?

Putting all your production eggs in one basket has always carried risk, but today's geopolitical climate has amplified those dangers exponentially. The rapid escalation of tariffs has caught many brands unprepared.

Relying solely on China now means facing 104% tariffs as of April 10, 2025, while single-country alternatives like Vietnam (46% tariff), Cambodia (49% tariff), or Bangladesh also face uncertainty. The safest approach combines China's material strength with Southeast Asian production, creating flexibility to pivot as policies change.

The tariff landscape has changed dramatically in just the past week. President Trump's April 2nd announcement established a baseline 10% tariff on all imports, with additional targeted tariffs on specific countries. Then on April 8th, he tripled the previously announced tariff rates on low-value packages from China to 90% of the shipment's value, rising to $150 after June 1. For underwear manufacturers, this creates unprecedented challenges.

Understanding the New Tariff Reality

The current tariff structure has created a complex web of duties that varies significantly by country. China now faces a combined duty of 104% as of April 10, 2025. Meanwhile, other popular manufacturing locations face their own substantial tariffs: Vietnam at 46%, Cambodia at 49%, and Bangladesh at lower but still significant rates.

What makes this situation particularly challenging is the unpredictability. As Treasury Secretary Scott Bessent noted, about 70 countries have reached out to the White House with "inquiries" about the tariffs, and they're "starting the negotiations right now". This means the tariff landscape could shift again at any moment.

The Hidden Risks of Single-Country Dependency

Beyond tariffs, each manufacturing location carries its own set of risks:

| Country | Current Tariff Risk | Political Stability Risk | Infrastructure Risk | Supply Chain Risk |

|---|---|---|---|---|

| China | Very High (104%) | Moderate | Low | Low |

| Vietnam | High (46%) | Moderate | Moderate | Moderate |

| Cambodia | Very High (49%) | High | High | High |

| Bangladesh | Moderate | High | High | Moderate |

Cambodia, which faces the steepest single-nation tariff rate at 49%, illustrates the severity of the situation. According to trade groups, factories based in Cambodia will "absolutely not" be returning to the U.S. as hoped by the administration. Instead, they're seeking alternative manufacturing locations in lower tariff regimes. This pattern is repeating across Southeast Asia, creating a complex reshuffling of global supply chains.

The reality is that no single location provides complete security in today's volatile trade environment. A diversified approach is no longer just a nice-to-have—it's essential for survival.

How Does the China+Southeast Asia Model Create Resilience?

Many underwear brands are struggling to find the right balance between cost, quality, and risk in their manufacturing strategy. The wrong approach could lead to quality issues, supply disruptions, or unsustainable costs.

The optimal strategy leverages China's superior material sourcing and technical expertise while utilizing Southeast Asian production (particularly Bangladesh) to mitigate tariff impacts. This approach maintains quality through standardized processes while reducing landed costs by 15-16% compared to China-only production.

At HAVING, we've developed a hybrid manufacturing model that combines the strengths of both China and Bangladesh. This approach has proven particularly valuable during the current tariff turbulence, allowing us to help clients maintain both quality and competitive pricing.

The Strategic Advantages of a Dual-Location Approach

The China+Southeast Asia model works by strategically dividing the production process based on each location's strengths:

-

Material Sourcing & Development in China: China remains unmatched in material quality, innovation, and supply chain efficiency. By maintaining our material sourcing and R&D operations in China, we ensure access to the best fabrics, trims, and technical innovations.

-

Production in Southeast Asia: For actual manufacturing, Bangladesh offers significant advantages, particularly for standard underwear products. With labor costs of $0.7-1/hour versus China's $3-4/hour and the avoidance of Section 301 tariffs, the total landed cost savings typically range from 15-16%.

-

Technical Transfer Systems: The key to making this model work is having robust systems for transferring technical specifications, quality standards, and production knowledge between locations. Our senior technical staff regularly rotates between facilities, ensuring consistent standards.

The Economics of Dual-Location Manufacturing

Let's look at the actual numbers for a typical women's underwear 5-pack to understand the economic impact:

| Cost Component | China (USD) | Bangladesh (USD) | Difference |

|---|---|---|---|

| Raw Materials | $2.00 | $2.30 | +15% |

| Labor | $1.00 | $1.00 | 0% |

| Overhead & Other | $2.00 | $2.00 | 0% |

| Total FOB Cost | $5.00 | $5.30 | +6% |

| Base Tariff (15.6%) | $0.78 | $0.83 | +6% |

| Section 301 Tariff | $3.075(7.5%+10%+10%+34%) | $1.961(37%) | -36.2% |

| Additional Tariff (April.9 2025) | $2.5(50%) | $0.00 | -100% |

| Total Landed Cost | $11.355 | $8.091 | -28.7% |

With the April 2025 tariff increases, the cost difference has become even more dramatic. While Bangladesh production might have slightly higher FOB costs due to material imports and efficiency differences, the tariff avoidance creates substantial overall savings.

One particularly advantageous option we've developed is bonded manufacturing in Bangladesh. This approach allows materials to be imported duty-free for export production, further enhancing cost advantages while maintaining quality. Currently, there are very few facilities offering bonded underwear production in Bangladesh, giving our clients a significant competitive edge.

What Makes Bangladesh an Attractive Alternative to China for Underwear Production?

Many brands are hesitant to explore Bangladesh as a manufacturing option due to concerns about quality, capabilities, or stability. These misconceptions can prevent them from capturing significant cost advantages.

Bangladesh excels at producing basic cotton underwear, standard bras, and men's boxers/briefs with modern equipment and skilled labor. With proper quality systems, defect rates average under 1% (vs. 0.8% in China), while offering 15-16% landed cost savings and avoiding the new 104% China tariffs.

Bangladesh has evolved significantly as a manufacturing destination over the past decade. As the world's second-largest garment exporter after China, the country has developed substantial expertise in underwear production specifically.

Bangladesh's Manufacturing Capabilities

Our Bangladesh facility has gradually built production capacity to approximately 300,000 pieces monthly, representing about 60% of our Chinese facility's output. This scale allows us to accommodate both large retail orders and smaller specialty brand requirements.

The country particularly excels in:

| Product Category | Bangladesh Capability | China Capability | Recommendation |

|---|---|---|---|

| Basic Cotton Underwear | Excellent | Excellent | Ideal for Bangladesh |

| Standard Bras (Non-technical) | Good | Excellent | Suitable for Bangladesh with proper QC |

| Technical Sports Bras | Fair | Excellent | Recommend China production |

| Men's Briefs/Boxers | Excellent | Excellent | Ideal for Bangladesh |

| Women's Basic Panties | Excellent | Excellent | Ideal for Bangladesh |

The key to successful Bangladesh production is matching the right products to the country's strengths. Basic products with straightforward construction, fewer components, and standard materials are excellent candidates for Bangladesh manufacturing.

Quality Control Systems

One of the most common concerns about Bangladesh production is quality consistency. We've addressed this by implementing identical quality control measures across all facilities:

-

Standardized Operating Procedures: The same quality management system, testing protocols, inspection checklists, and defect classification systems are used in both China and Bangladesh.

-

Cross-Facility Training: Senior quality control personnel regularly conduct training sessions across facilities, while staff completes rotation programs between locations.

-

Unified Digital Quality Management: Our centralized system tracks real-time production quality metrics, identifies recurring issues, and allows for quick corrective actions.

These systems have enabled our Bangladesh facility to achieve defect rates averaging under 1%, compared to 0.8% in our Chinese operations—a negligible difference for most product categories.

The Bonded Manufacturing Advantage

One particularly valuable option we've developed is bonded manufacturing in Bangladesh. This approach allows materials to be imported duty-free for export production, addressing one of the key challenges of Bangladesh manufacturing—access to high-quality materials.

Currently, there are very few facilities offering bonded underwear production in Bangladesh, giving our clients a significant competitive edge. This approach combines the quality advantages of imported materials with the cost benefits of Bangladesh production and tariff avoidance.

How Can You Implement a Dual-Location Strategy Without Disrupting Your Supply Chain?

Transitioning manufacturing locations can be daunting. Many brands fear production disruptions, quality inconsistencies, or management complications during the change.

Start with a structured six-step process: 1) Assess product suitability for Bangladesh, 2) Transfer technical specifications from China, 3) Produce and approve samples, 4) Run a 3,000-5,000 piece pilot production, 5) Evaluate quality and adjust processes, and 6) Scale up production gradually while maintaining China capacity.

Our production transfer system has been refined through dozens of successful transitions for international clients. The process begins with a comprehensive feasibility analysis that evaluates the technical requirements, material availability, quality parameters, and cost implications of shifting specific products to Bangladesh.

The Six-Step Transfer Process

| Transfer Phase | Timeline | Key Activities |

|---|---|---|

| 1. Initial Assessment | 2-3 weeks | • Product evaluation • Material sourcing verification • Cost analysis • Technical feasibility check |

| 2. Technical Package Transfer | 3-4 weeks | • Pattern development/transfer • Material specification • Construction guides • Quality standards documentation |

| 3. Sample Development | 2-3 weeks | • First sample production • Sample testing • Comparison with reference samples • Process adjustment |

| 4. Pilot Production | 4-5 weeks | • Limited production run (3,000-5,000 pcs) • Process refinement • Quality verification • Packaging validation |

| 5. Quality Evaluation | 1-2 weeks | • Comprehensive quality assessment • Process adjustment • Performance metrics review • Final approval |

| 6. Full Implementation | Ongoing | • Regular production • Continuous improvement • Performance monitoring • Regular quality audits |

This structured approach minimizes risk while allowing you to build confidence in the new production location. The entire process typically takes 3-4 months for the first product category, with subsequent categories moving more quickly as systems are established.

Risk Management Strategies

Even with careful planning, it's essential to implement robust risk management strategies:

-

Maintain Production Flexibility: Keep some production capacity in China, especially for complex or quick-turn products. This dual-facility capability allows for quick adjustments in response to changing conditions.

-

Develop Contingency Plans: Create specific plans for potential disruptions like political instability, natural disasters, or sudden policy changes.

-

Establish Backup Material Sourcing: Maintain relationships with multiple approved suppliers for critical materials, including options through the Chinese supply chain when necessary.

-

Implement Logistics Flexibility: Utilize multiple shipping companies and port options to avoid dependency on any single transportation route.

-

Adjust Inventory Strategies: Consider increasing safety stock levels slightly during the initial transition period, gradually optimizing as confidence in the new supply chain grows.

The current tariff situation actually presents a strategic opportunity. As some brands exit China entirely or struggle with rising costs, establishing a dual-location strategy now positions you for long-term advantage. Even if tariffs eventually decrease, the global underwear supply chain will have reached a new equilibrium at higher price points. Having flexible production options will remain valuable regardless of how policies evolve.

What Should You Look for in a Manufacturing Partner During These Uncertain Times?

Finding the right manufacturing partner is critical in navigating today's volatile trade environment. The wrong choice could leave you vulnerable to quality issues, supply disruptions, or inability to adapt to policy changes.

Look for partners with established facilities in multiple countries, particularly China+Bangladesh combinations. Verify quality systems are standardized across locations, check certifications (ISO 9001, SA8000, WRAP), and ensure they have experience managing tariff-driven transitions for other clients.

The most valuable manufacturing partners in today's environment offer more than just production capacity—they provide strategic flexibility and risk management. Based on our experience helping clients navigate tariff challenges, several factors stand out as particularly important.

Key Criteria for Selecting Manufacturing Partners

-

Multi-Country Production Capability: Partners with established facilities in both China and Southeast Asia offer the greatest flexibility. This allows for strategic allocation of production based on product type, tariff considerations, and timeline requirements.

-

Standardized Quality Systems: Look for manufacturers who maintain identical quality control measures across all facilities, including standardized operating procedures, cross-facility training, and unified quality management systems.

-

Technical Transfer Expertise: The ability to effectively transfer technical specifications, quality standards, and production knowledge between locations is critical for maintaining consistency.

-

Material Sourcing Networks: Strong relationships with material suppliers across multiple countries enable cost-effective sourcing regardless of production location.

-

Compliance Certifications: Verify relevant certifications including quality management (ISO 9001), social compliance (SA8000, WRAP, BSCI), and environmental standards.

-

Experience with Tariff-Driven Transitions: Partners who have successfully helped other clients navigate tariff challenges will have established processes and realistic timelines.

-

Transparent Communication: Clear, honest communication about capabilities, limitations, and potential challenges is essential for effective partnership.

Starting the Conversation

For brands considering a manufacturing transition, I recommend beginning with a strategic assessment conversation. This initial discussion should cover:

-

Product Portfolio Analysis: Which products are best suited for potential transition based on complexity, volume, and margin sensitivity?

-

Cost Impact Assessment: How would a dual-location strategy affect your specific products' landed costs under current and potential future tariff scenarios?

-

Timeline and Risk Evaluation: What realistic timeline would a transition require, and what risks would need to be managed?

-

Pilot Project Planning: Which specific products would make ideal candidates for an initial trial production?

Even if you're not ready to make immediate changes, establishing relationships with manufacturers who offer multi-country production provides valuable optionality. As the tariff situation continues to evolve, having these connections already in place allows for faster adaptation when needed.

Conclusion

The underwear manufacturing landscape has been dramatically reshaped by the April 2025 tariff announcements. With China now facing 104% duties and other countries also targeted, the most resilient strategy combines China's technical strengths with Southeast Asian production advantages. This dual-location approach offers both immediate cost savings and long-term flexibility to adapt as trade policies continue to evolve.