Comprendre le marché des sous-vêtements de période: tendances, démographie & Opportunités pour les acheteurs B2B?

Le marché des sous-vêtements de période évolue rapidement, mais de nombreuses entreprises ont du mal à identifier les segments de consommation les plus rentables et les tendances émergentes. Sans informations sur le marché, vous risquez d'investir dans des produits qui ne résonnent pas avec les menstruateurs d'aujourd'hui.

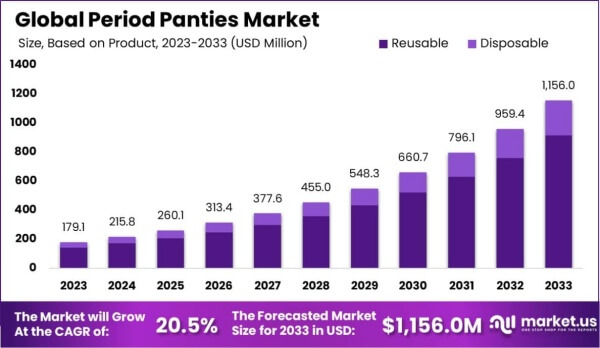

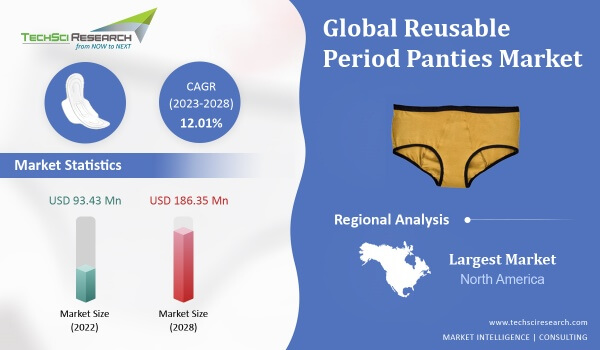

Le marché mondial des sous-vêtements devrait atteindre 279,3 millions de dollars d'ici 2026, augmentant à un TCAC de 14,1% par rapport à 2021. Cette croissance est motivée par l'augmentation de la conscience de l'environnement, des préférences de confort et le changement vers des solutions menstruelles durables qui offrent à la fois la commodité et le coût de l'efficacité au fil du temps.

En tant que personne qui a contribué à transformer les sous-vêtements de période du produit de niche à un grand public essentiel à l'avoir, j'ai eu un siège au premier rang à la croissance explosive de ce marché. Notre voyage de la production de zéro unités à la fabrication de plus de 2 millions de pièces par an pour que les grands détaillants comme Primark m'ont donné des informations uniques sur ce qui fait avancer cette catégorie.

Qu'est-ce qui stimule la croissance du marché des sous-vêtements?

Le marché traditionnel des produits menstruels est resté relativement inchangé depuis des décennies. Des tampons jetables et des tampons ont dominé, laissant aux consommateurs des options limitées qui provoquaient souvent l'inconfort, la culpabilité de l'environnement et les dépenses en cours.

Les ventes de sous-vêtements de période augmentent 3 à 4 fois plus rapides que le marché global des vêtements intimes, motivé par quatre facteurs clés: les préoccupations environnementales (79% des consommateurs citent la durabilité comme importantes dans les décisions d'achat), les avantages de confort par rapport aux produits ciblés, les économies de coûts à long terme et la disponibilité de la vente au détail en plus

Lorsque nous avons commencé à fabriquer des sous-vêtements de période à avoir, la catégorie a été principalement vendue auprès des détaillants spécialisés et des marques directes aux consommateurs. Aujourd'hui, nous produisons ces produits pour les grands détaillants, les marques de mode et même les sociétés de vêtements de sport. Ce passage du niche au courant dominant a été alimenté par plusieurs tendances interconnectées:

Mouvement de durabilité

La conscience environnementale est devenue un moteur d'achat majeur, en particulier chez les jeunes consommateurs. Considérez ces statistiques:

| Impact environnemental | Produits traditionnels | Sous-vêtements d'époque |

|---|---|---|

| Déchets générés (vie) | 5 000 à 15 000 produits jetables | 20 à 30 paires (remplacées tous les 2-3 ans) |

| Contenu en plastique | 90% des coussinets contiennent du plastique | Peut être fabriqué avec un minimum / sans plastique |

| Empreinte carbone | Haute (fabrication continue) | Inférieur (production ponctuelle) |

Une récente enquête a révélé que 79% des personnes menstruées sont préoccupées par l'impact environnemental de leurs produits d'époque. Cette préoccupation se traduit directement par un comportement d'achat, 64% disposés à payer plus pour des alternatives durables.

Révolution du confort

Les produits à l'époque traditionnelle présentent des inconvénients importants:

- Les coussinets peuvent se sentir encombrants et provoquer des frottements

- Les tampons peuvent provoquer la sécheresse et l'inconfort

- Les deux nécessitent des changements fréquents et peuvent fuir

Les sous-vêtements de période abordent ces points de douleur en fournissant:

- Une expérience transparente qui ressemble à des sous-vêtements réguliers

- Confort toute la journée sans avoir besoin de changements fréquents

- Réduction de l'anxiété à propos des fuites et des taches

Notre développement de produits à Have a se concentre fortement sur le maintien du confort même avec les couches absorbantes supplémentaires. Les commentaires des utilisateurs finaux mettent constamment le confort comme une raison principale de passer aux sous-vêtements d'époque.

Avantages économiques

Bien que les sous-vêtements de période nécessitent un investissement initial plus élevé que les produits jetables, les économies à long terme sont substantielles:

| Comparaison des coûts | Produits jetables | Sous-vêtements d'époque |

|---|---|---|

| Coût mensuel initial | 5-15 $ | 80 à 150 $ (pour 4-6 paires) |

| Coût annuel | 60 à 180 $ | 20-40 $ (paires de remplacement) |

| Coût de 3 ans | 180-540 $ | 120 à 270 $ |

Cette proposition de valeur est de plus en plus attrayante pour les consommateurs soucieux du budget, d'autant plus que l'inflation a un impact sur les dépenses des ménages. Pour avoir, nous avons constaté un intérêt croissant pour les sous-vêtements de la période à travers les prix, des options budgétaires aux offres premium.

Expansion au détail

La disponibilité accrue des sous-vêtements de période dans les canaux de vente au détail traditionnels a considérablement accéléré la croissance du marché. Ce qui était autrefois principalement vendu auprès des détaillants spécialisés et des marques directes aux consommateurs est désormais disponible dans:

- Détaillants de marché de masse (Target, Walmart, Primark)

- Grands magasins

- Pharmacies et pharmacies

- Chaînes d'épicerie

- Magasins d'articles de sport (pour les sous-vêtements de la période sportive)

Cette distribution élargie a à la fois répondu et alimenté la demande des consommateurs. Nos données de fabrication montrent que les commandes de détail ont augmenté de façon exponentielle car de plus en plus de magasins ajoutent des sous-vêtements de période à leurs assortiments.

Pour un aperçu complet de l'ensemble de la catégorie des sous-vêtements de la période, y compris les considérations de fabrication et les opportunités de partenariat, visitez notre Guide ultime B2B de l'approvisionnement & Vente des sous-vêtements de période.

Qui achète des sous-vêtements de période?

De nombreuses entreprises font l'erreur de cibler une démographie trop étroite. Le marché des sous-vêtements de la période s'est développé bien au-delà des premiers adoptants pour inclure divers segments de consommateurs avec des besoins et des préférences différents.

Les sous-vêtements de la période font appel à plusieurs segments de consommateurs: les individus respectueux de l'environnement (principalement 18-34), les demandeurs de confort dans tous les groupes d'âge, les individus actifs ayant besoin d'une protection contre les fuites pendant l'exercice, des adolescents / tweens entrant sur le marché menstruel, et ceux qui ont des besoins spéciaux, notamment les mères post-partum et les personnes handicapées ou les problèmes de mobilité.

Pour avoir, nous avons fabriqué des sous-vêtements d'époque pour les marques ciblant divers segments démographiques. Cette expérience nous a donné un aperçu des divers groupes de consommateurs stimulant la croissance du marché:

Segments démographiques de base

Consommateurs à l'éco-conscience (marché primaire)

- Âge: Principalement 18-34

- Caractéristiques: Conscient de l'environnement, prêt à payer des primes pour les produits durables

- Motivations: Réduire les déchets, éviter les produits chimiques dans les produits traditionnels

- Comportement d'achat: Orienté vers la recherche, influencé par les certifications de durabilité et les valeurs de la marque

Ce segment a été l'adoption précoce des sous-vêtements d'époque et reste un marché central. Ils sont prêts à payer plus pour les produits qui s'alignent avec leurs valeurs et deviennent souvent des défenseurs de la marque.

Les demandeurs de confort (segment la plus rapide)

- Âge: S'étend sur tous les groupes d'âge

- Caractéristiques: Prioriser le confort physique et la commodité

- Motivations: Éviter l'inconfort des produits traditionnels, simplifiant la gestion de la période

- Comportement d'achat: Influencé par les examens de produits et les allégations de confort

Ce segment s'est considérablement développé à mesure que le bouche à oreille sur les avantages de confort des sous-vêtements de période s'est propagé. Ils sont moins préoccupés par les avantages environnementaux et plus axés sur l'expérience personnelle.

Consommateurs de style de vie actif

- Âge: Principalement 16-45

- Caractéristiques: Participez régulièrement à des activités sportives ou de fitness

- Motivations: Protection des fuites pendant le mouvement, éviter les perturbations de la routine

- Comportement d'achat: Acheter chez les détaillants d'articles de sport, influencés par les réclamations de performance

Ce segment a motivé le développement de produits spécialisés comme les sous-vêtements de la période de yoga et les maillots de bain en période. Pour avoir, nous avons constaté une croissance significative des commandes de ces variantes fonctionnelles spécialisées.

Adolescents et préadolescents (segment émergent)

- Âge: 10-17

- Caractéristiques: Nouveau à la menstruation, souvent guidé par les parents dans la sélection des produits

- Motivations: Facilité d'utilisation, réduction de l'embarras, prévention des fuites

- Comportement d'achat: Produits souvent achetés par les parents, influencés par l'éducation et la simplicité

Ce segment représente une opportunité de croissance importante. Les parents recherchent de plus en plus des options durables et sans produits chimiques pour leurs enfants qui entrent dans la puberté.

Consommations de besoins spéciaux

- Post-partum: Recherche d'une forte absorption pour les saignements post-naissance

- Incontinence: En utilisant des sous-vêtements de période pour une fuite de vessie légère (comme nos produits pour VIITA)

- Problèmes de mobilité: Bénéficier de la facilité d'utilisation par rapport aux produits jetables

- Sensibilités sensorielles: Appréciation de la sensation sans couture et cohérente contre la peau

Ces segments de niche ont souvent des exigences spécifiques mais représentent des opportunités de marché précieuses avec moins de concurrence.

Distribution du marché géographique

Le marché des sous-vêtements de période montre des variations régionales importantes:

| Région | Part de marché | Taux de croissance | Caractéristiques clés |

|---|---|---|---|

| Amérique du Nord | 42% | 13,5% | Marché adoptant précoce, Haute au foyer de durabilité |

| Europe | 31% | 15,2% | Forte croissance au Royaume-Uni, en Allemagne, nordiques |

| Asie-Pacifique | 18% | 16,8% | Région à la croissance la plus rapide, dirigée par l'Australie, le Japon |

| Reste du monde | 9% | 11,3% | Marchés émergents avec un potentiel significatif |

Nos données manufacturières pour avoir reflété ces différences régionales. Les commandes européennes ont augmenté particulièrement rapidement au cours des deux dernières années, avec le Royaume-Uni et l'Allemagne à l'adoption.

Pour des informations détaillées sur la façon de développer des produits adaptés à ces différents segments de consommateurs, explorez notre guide sur CARANT VOTRE collection: un guide B2B des styles de sous-vêtements d'époque, absorbations & Options matérielles.

Quelles sont les principales tendances du marché qui façonnent l'avenir?

Le marché des sous-vêtements de période continue d'évoluer rapidement. Les entreprises qui ne prévoient pas que les tendances émergentes risquent d'être laissées pour les préférences des consommateurs.

Les tendances émergentes sur le marché des sous-vêtements de la période comprennent une fonctionnalité élargie (usure sportive, maillots de bain, vêtements de nuit), accent accru sur le dimensionnement et les conceptions inclusifs, les innovations technologiques dans les matériaux absorbants et la montée des modèles d'abonnement. De plus, les marques de mode traditionnelles entrent de plus en plus dans la catégorie, signalant son mouvement de niche au courant dominant.

Pour avoir, nous innovons constamment pour rester en avance sur les tendances du marché. Voici les principaux développements que nous constatons qui façonneront l'avenir de cette catégorie:

Fonctionnalité élargie

Les sous-vêtements de période évoluent au-delà de la protection de base pour inclure des fonctions spécialisées:

-

Usure de la période athlétique: Conçu spécifiquement pour l'exercice, avec des propriétés de pivot d'humidité et un placement d'absorption stratégique. Les grandes marques de vêtements de sport comme Adidas sont entrées dans cet espace.

-

Swimwear d'époque: L'une des sous-catégories à la croissance la plus rapide, offrant une protection contre les fuites pendant les activités nautiques. Nous avons développé ces produits pour plusieurs marques de maillots de bain.

-

Designs axés sur le sommeil: Options d'absorbance plus élevées spécialement conçues pour une protection de nuit, souvent avec une couverture étendue.

-

Croisement d'incontinence: Produits conçus pour aborder à la fois le flux menstruel et la fuite de la vessie légère, élargissant considérablement le marché potentiel. Notre travail avec Viita montre le potentiel de cet espace.

Inclusivité Push

Le marché répond aux demandes d'une plus grande inclusivité:

-

Extension de plage de taille: Les marques étendent les offres de taille, certaines couvrant désormais XXS à 6XL.

-

Options non sexistes: S'éloigner des conceptions traditionnellement féminines pour accueillir des utilisateurs transgenres et non binaires.

-

Conceptions adaptatives: Produits avec des fonctionnalités les rend plus faciles à utiliser pour les personnes handicapées ou les problèmes de mobilité.

-

Sensibilité culturelle: Designs abordant des préférences culturelles ou religieuses spécifiques concernant la modestie et les menstruations.

Innovation matérielle et technologique

R&D est axé sur l'amélioration des performances des sous-vêtements de période:

-

Absorption accrue: Nouveaux matériaux offrant une plus grande capacité sans masse ajoutée.

-

Séchage plus rapide: Innovations réduisant le temps de séchage après le lavage, un point de douleur au consommateur commun.

-

Contrôle des odeurs: Technologies avancées répondant aux préoccupations des odeurs sans produits chimiques nocifs.

-

Matériaux durables: Utilisation accrue de composants organiques, recyclés et biodégradables.

Pour avoir, nous avons investi dans le développement de ces améliorations technologiques, en particulier dans la création de couches absorbantes sans PFAS qui maintiennent des performances élevées.

Évolution du modèle commercial

La façon dont les sous-vêtements de période sont vendus changent:

-

Services d'abonnement: Marques offrant des livraisons régulières de produits de remplacement, créant des revenus récurrents.

-

Tarification de l'effet: Encourager l'achat de plusieurs paires via des ensembles à prix réduit.

-

Try avant-toi: Programmes permettant aux clients de tester des produits avant de s'engager, à s'attaquer à l'hésitation à la première vente.

-

Gammes de produits hybrides: Marques offrant des options jetables et réutilisables pour saisir différentes occasions d'utilisation.

Entrée de marque grand public

La tendance la plus importante est peut-être l'entrée de marques de mode et de vêtements intimes établies dans l'espace des sous-vêtements de la période:

-

Expansion des vêtements intimes: Marques de sous-vêtements traditionnelles ajoutant des produits d'époque à leurs lignes.

-

Collaboration de la marque de mode: Collaborations de créateurs apportant des références de style aux produits fonctionnels.

-

Étiquettes privées au détail: Les principaux détaillants développaient leurs propres lignes de sous-vêtements d'époque (comme notre travail avec Primark).

-

Intégration de vêtements de sport: Les marques sportives incorporant la protection des périodes dans l'usure des performances.

Cela indique la transition de la catégorie du créneau à un potentiel de marché essentiel et considérablement en expansion.

Pour plus d'informations sur la façon dont ces tendances affectent les considérations de fabrication et la sélection des matériaux, visitez notre guide détaillé sur Technologie des sous-vêtements de période & Matériaux: Guide de l'acheteur de l'absorption, tissus & Fuite.

Quel est le paysage concurrentiel des sous-vêtements d'époque?

Comprendre l'environnement concurrentiel est crucial pour positionner efficacement votre marque. Le marché des sous-vêtements de période est passé de quelques marques pionnières à un écosystème diversifié de concurrents.

Le marché des sous-vêtements de période est passé de la domicile par des marques de DTC pionnières pour inclure des détaillants grand public, des sociétés de vêtements intimes établies et des marques durables spécialisées. La concurrence s'intensifie à mesure que la catégorie se développe, la différenciation se produisant grâce à la technologie d'absorption, aux références de durabilité, au positionnement des prix et aux fonctionnalités spécialisées.

Pour avoir, nous avons fabriqué pour divers acteurs dans ce paysage compétitif. Cette expérience nous a donné un aperçu de la façon dont les différentes marques se positionnent et rivalisent pour la part de marché:

Segmentation du marché par type de marque

Le marché des sous-vêtements de période comprend plusieurs catégories de concurrents distinctes:

Marques pionnières directes aux consommateurs

- Caractéristiques: First-Movers qui a construit la catégorie

- Positionnement: Prix premium, solide reconnaissance de la marque

- Avantages: Base de clientèle établie, expertise en catégorie

- Défis: Défendre des parts de marché contre les nouveaux entrants, les frais d'acquisition des clients élevés

Ces marques ont créé la catégorie mais sont désormais confrontées à une concurrence croissante de plus grands acteurs avec des ressources plus importantes.

Détaillants grand public & Étiquettes privées

- Caractéristiques: Portée du marché de masse, prix compétitifs

- Positionnement: Accessibilité, abordabilité

- Avantages: Base de clientèle existante, puissance de distribution

- Défis: Construire la crédibilité de la catégorie, éduquer les consommateurs

Notre travail avec Primark illustre le potentiel de ce segment, passant de zéro à 2 millions d'unités par an alors que les consommateurs adoptent des prix plus accessibles.

Marques de vêtements intimes établies

- Caractéristiques: Tirant parti des capitaux propres existants en sous-vêtements

- Positionnement: Qualité fiable, marque familière

- Avantages: Relations avec les clients existants, distribution de vente au détail

- Défis: Démontrer l'expertise technique en absorption

Ces marques bénéficient de la confiance des consommateurs mais doivent prouver leurs capacités techniques dans cette catégorie fonctionnelle.

Marques durables / éthiques

- Caractéristiques: Fortement l'accent mis sur l'impact environnemental et social

- Positionnement: Option la plus écologique, pratiques transparentes

- Avantages: Appel aux consommateurs axés sur les valeurs

- Défis: Équilibrer la durabilité avec les performances et le prix

Ce segment continue de croître à mesure que les préoccupations environnementales deviennent plus courantes.

Marques fonctionnelles spécialisées

- Caractéristiques: Concentrez-vous sur des cas d'utilisation spécifiques (sports, adolescents, post-partum)

- Positionnement: Meilleurs de sa catégorie pour des besoins spécifiques

- Avantages: Proposition de valeur claire pour le segment cible

- Défis: Taille limitée du marché, s'étendre au-delà de la niche

Ces marques rivalisent en résolvant mieux des problèmes spécifiques que les alternatives à usage général.

Stratégies de différenciation compétitive

Les marques se différencient à travers plusieurs facteurs clés:

Technologie & Performance

- Niveaux d'absorption: Allant de la lumière (1 équivalent de tampon) à Ultra (4+ tampons)

- Protection contre les fuites: Des approches variables des barrières à l'épreuve des fuites

- Caractéristiques de confort: Innovations dans la conception de gousset, couture, ceinture

- Temps de séchage: S'attaquer à un point de douleur au consommateur clé

Positionnement des prix

| Segment de marché | Gamme de prix de détail typique | Proposition de valeur |

|---|---|---|

| Budget | 12-20 $ | Accessibilité, entrée de gamme |

| Intermédiaire | 20-30 $ | Équilibre de la qualité et de la valeur |

| Prime | 30 à 45 $ | Performance supérieure, durabilité |

| Luxe | 45 $ + | Matériaux premium, prestige de marque |

Des références de durabilité

- Matériels: Coton biologique, fibres recyclées, composants biodégradables

- Fabrication: Production éthique, conservation de l'eau, efficacité énergétique

- Emballage: Sans plastique, recyclable, minimaliste

- Fin de vie: Biodégradabilité, programmes de recyclage

Stratégie de distribution

- Direct à consommateur: Établir des relations avec les clients directs

- Partenariats de vente au détail: Tirer parti des comportements d'achat existants

- Omnicanal: Équilibrer la présence directe et commerciale

- Expansion internationale: S'attaquer aux opportunités du marché mondial

Pour plus d'informations sur la façon de positionner efficacement votre marque dans ce paysage concurrentiel, explorez notre guide sur Maximiser votre ROI: Prix en gros de sous-vêtements de période, marges de vente au détail & Analyse de la rentabilité.

Quelles sont les plus grandes opportunités pour les acheteurs B2B?

Le marché des sous-vêtements en évolution présente de nombreuses opportunités pour les acheteurs B2B, mais l'identification des domaines les plus prometteurs nécessite des informations sur le marché et une pensée stratégique.

Les principales opportunités pour les acheteurs B2B comprennent la saisie des segments de marché mal desservis (adolescents, plus tailles, athlétique), développer des variantes fonctionnelles spécialisées (maillots de bain, vêtements de nuit, vêtements de sport), créant des options plus abordables pour étendre la portée du marché et établir des modèles d'abonnement pour les revenus récurrents et la rétention de la clientèle.

Pour avoir, nous avons aidé de nombreuses marques à identifier et à tirer parti des opportunités de marché. Sur la base de notre expérience et de notre analyse du marché, voici les domaines les plus prometteurs que les acheteurs B2B peuvent explorer:

Segments de marché mal desservis

Plusieurs segments de consommateurs restent mal desservis malgré une forte demande:

Marché adolescent / tween

- Taille d'opportunité: Environ 15% du potentiel du marché total

- État actuel: Options limitées spécialement conçues pour les jeunes utilisateurs

- Exigences clés: Designs adaptés à l'âge, marketing axé sur l'éducation, messagerie adaptée aux parents

- Potentiel de croissance: 18-20% par an

Nous avons constaté un intérêt croissant de la part des marques développant des lignes spécifiques aux adolescents, avec des conceptions simplifiées et des composants éducatifs.

Marché de taille plus

- Taille d'opportunité: 20-25% des utilisateurs potentiels

- État actuel: Options de taille étendue limitée, en particulier au-dessus de 3x

- Exigences clés: Considérations d'ajustement réfléchies, marketing inclusif, gamme de taille étendue

- Potentiel de croissance: 16-18% par an

Les marques qui ont élargi leurs gammes de taille ont signalé une forte croissance des ventes et une fidélité des clients.

Marché athlétique / actif

- Taille d'opportunité: 30% des utilisateurs recherchent une protection des règles pendant l'exercice

- État actuel: Options croissantes mais toujours limitées spécialement conçues pour le mouvement

- Exigences clés: Support de gousset amélioré, propriétés à séchage rapide et à séchage à l'humidité

- Potentiel de croissance: 20-22% par an

Notre travail de développement avec des marques de vêtements de sport a montré une demande importante de sous-vêtements d'époque spécialement conçus pour l'exercice.

Spécialisation fonctionnelle

Le développement de produits pour des cas d'utilisation spécifiques offre un potentiel de croissance significatif:

Swimwear d'époque

- Statut du marché: Stage précoce avec des options limitées

- Besoin des consommateurs: Protection des périodes pendant les activités nautiques

- Exigences techniques: Matériaux à séchage rapide et résistant au chlore

- Projection de croissance: 25-30% par an

Cette catégorie a montré une croissance particulièrement forte de nos données de fabrication, avec plusieurs marques de maillots de bain ajoutant des options de protection des périodes.

Designs axés sur le sommeil

- Statut du marché: Catégorie émergente

- Besoin des consommateurs: Protection de nuit sans fuites

- Exigences techniques: Absorbance plus élevée, couverture prolongée

- Projection de croissance: 18-20% par an

Les produits spécialisés du jour au lendemain traitent d'un point de douleur commun et de prix premium de commande.

Croisement d'incontinence

- Statut du marché: Offrandes limitées malgré un marché potentiel important

- Besoin des consommateurs: Protection discrète pour la fuite de la vessie légère

- Exigences techniques: Placement d'absorbance spécialisé, contrôle des odeurs

- Projection de croissance: 22-25% par an

Notre travail avec VIITA montre le potentiel de produits répondant à la fois aux besoins menstruels et à l'incontinence.

Innovation des prix

La création de prix plus accessibles peut élargir considérablement la portée du marché:

Options d'entrée de gamme

- Espace actuel: Options de qualité limitée inférieures à 20 $

- Opportunité: Designs simplifiés avec des performances essentielles

- Marché cible: Consommateurs sensibles aux prix, acheteurs pour la première fois

- Stratégie: Fabrication basée sur le volume, styles rationalisés

Notre expérience avec Primark montre que les sous-vêtements de la période de qualité à des prix accessibles peuvent générer un volume massif.

Valeur du pack en vrac

- Espace actuel: Peu de marques offrent des économies multiples

- Opportunité: Boundles de 3 à 7 paires à des prix réduits par unité

- Marché cible: Utilisateurs engagés cherchant à créer une collection

- Stratégie: Emballage simplifié, efficacité du volume

Les offres groupées peuvent augmenter la valeur moyenne de la commande tout en fournissant la valeur des consommateurs.

Innovation du modèle d'entreprise

Au-delà du développement de produits, les modèles commerciaux innovants offrent des opportunités importantes:

Services d'abonnement

- État actuel: Offres d'abonnement limitées malgré la catégorie ajusté

- Opportunité: Programme de remplacement régulier (tous les 6 à 12 mois)

- Avantages: Revenus prévisibles, augmentation de la valeur à vie du client

- Mise en œuvre: Options de fréquence flexibles, incitations de fidélité

La nature récurrente des menstruations rend cette catégorie idéale pour les modèles d'abonnement.

Systèmes de produits hybrides

- État actuel: La plupart des marques offrent des options jetables ou réutilisables

- Opportunité: Des systèmes combinant les deux types de produits pour différentes situations

- Avantages: Aborde toutes les occasions d'utilisation, augmente la part du portefeuille

- Mise en œuvre: Développement de produits complémentaires, offres groupées

Cette approche reconnaît que la plupart des consommateurs utilisent une combinaison de types de produits.

Pour obtenir des conseils sur l'élaboration de produits pour tirer parti de ces opportunités, visitez notre ressource complète sur Votre marque, votre produit: le guide complet de la fabrication de sous-vêtements de la période de marque privée (OEM / ODM).

Conclusion

Le marché des sous-vêtements de période présente des opportunités de croissance exceptionnelles pour les acheteurs B2B qui comprennent le paysage en évolution. Avec une croissance à deux chiffres prévue pour les années à venir, l'entrée stratégique dans cette catégorie peut stimuler une expansion commerciale importante.

Pour avoir, nous nous engageons à soutenir votre succès sur ce marché dynamique avec notre expertise manufacturière et nos informations sur le marché.

Questions fréquemment posées (FAQ)

Quelle est la taille actuelle du marché mondial des sous-vêtements de la période?

Le marché mondial des sous-vêtements est actuellement évalué à environ 200 millions de dollars et devrait atteindre 279,3 millions de dollars d'ici 2026, augmentant à un TCAC de 14,1%.

Quels segments de consommateurs stimulent le plus de croissance des sous-vêtements d'époque?

Les segments à la croissance la plus rapide incluent les consommateurs respectueux de l'environnement (principalement 18-34), les individus de style de vie actifs qui recherchent pour la première fois des options sportives spécialisées et des adolescents / préadolescents entrant sur le marché menstruel.

Les sous-vêtements de période représentent actuellement environ 5% du marché total des soins menstruels, mais augmente à 3 à 4 fois le taux de produits jetables traditionnels, indiquant un potentiel de parts de marché future importante.

Quels prix fonctionnent le mieux sur le marché des sous-vêtements de la période?

Les produits à mi-marché (20-30 $ au détail) capturent actuellement la plus grande part de marché, mais la croissance se produit à la fois aux segments de prime (30 à 45 $) et de budget (12-20 $) à mesure que le marché se diversifie.

Comment les détaillants traditionnels affectent-ils le marché des sous-vêtements de la période?

Les principaux détaillants entrant dans la catégorie augmentent considérablement la portée du marché et la sensibilisation aux consommateurs. Leur entrée a accéléré la croissance en rendant les produits plus accessibles et en normalisant la catégorie des consommateurs traditionnels.

Quels sont les principaux obstacles à l'adoption des consommateurs des sous-vêtements en période?

Les principaux obstacles comprennent les préoccupations initiales des prix (coût initial plus élevé que les jetables), l'incertitude sur les performances et les questions de lavage / d'entretien. Le marketing et l'éducation efficaces peuvent répondre à ces préoccupations.

Comment le paysage concurrentiel devrait-il évoluer au cours des 3 à 5 prochaines années?

Le marché est susceptible de voir la consolidation entre les petites marques, l'entrée accrue par les sociétés de vêtements établies et la spécialisation plus importante dans les segments de niche à mesure que la catégorie globale mûrit.