Understanding the Activewear & Yoga Wear Market: Trends, Demographics & Opportunities for B2B Buyers?

The activewear and yoga wear market is evolving rapidly, but many businesses struggle to identify the most profitable consumer segments and emerging trends. Without market insights, you risk investing in products that won't resonate with today's fitness-focused consumers.

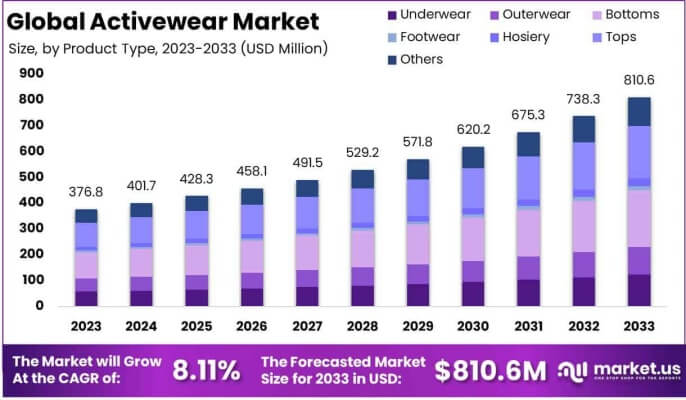

The global activewear market is projected to reach $547 billion by 2024, growing at a CAGR of 6.5%. This growth is driven by the athleisure trend, increasing health consciousness, and the integration of performance wear into everyday wardrobes, creating year-round demand that transcends traditional seasonal cycles.

As someone who's helped transform activewear from niche product to mainstream essential at HAVING, I've had a front-row seat to this market's explosive growth. Our journey to $30 million in annual sales serving over 3,000 stores has given me unique insights into what's driving this category forward.

What's Driving the Activewear & Yoga Wear Market Growth?

The traditional sportswear market has undergone a fundamental transformation. What was once designed purely for athletic performance has evolved into versatile athleisure that consumers wear throughout their day.

Activewear sales are growing 6-7% annually, significantly outpacing the broader apparel market's 1-2% growth. This acceleration is driven by four key factors: the athleisure lifestyle trend (79% of consumers wear activewear beyond workouts), increasing health consciousness, technical fabric innovations, and the rise of social media fitness culture.

When we first started manufacturing activewear at HAVING, the category was primarily performance-focused. Today, we're producing pieces that seamlessly transition from workout to everyday wear. This shift from niche to mainstream has been fueled by several interconnected trends:

The Athleisure Revolution

The most significant market driver has been the athleisure movement—the integration of performance wear into everyday wardrobes. Recent market research reveals:

| Consumer Behavior | Percentage | Business Implication |

|---|---|---|

| Wear activewear beyond workouts | 79% | Design must balance performance and style |

| Consider comfort the primary purchase driver | 85% | Comfort features should be highlighted in marketing |

| Own 5+ pairs of leggings | 64% | Consumers build activewear wardrobes, not just single pieces |

| Willing to pay premium for technical features | 57% | Performance attributes justify higher price points |

This trend has expanded the potential market far beyond traditional fitness enthusiasts, creating opportunities for brands to reach a much broader consumer base.

Wellness Lifestyle Integration

Fitness and wellness have become central to consumer identity and lifestyle:

- Yoga Participation: Over 300 million practitioners worldwide, growing 5-6% annually

- Fitness App Usage: 87% growth in fitness app downloads since 2019

- Home Workout Boom: 70% of consumers now exercise at home at least occasionally

- Wellness Identity: 65% of millennials consider wellness activities part of their personal identity

This integration of fitness into lifestyle has created demand for versatile activewear that performs during workouts but looks stylish enough for everyday settings.

Technical Innovation

Advancements in fabric technology have revolutionized activewear performance and comfort:

- Moisture-Wicking: Now expected as standard rather than premium feature

- Four-Way Stretch: Enabling greater range of motion and comfort

- Compression Technology: Offering muscle support and recovery benefits

- Temperature Regulation: Fabrics that cool or warm based on conditions

- Anti-Odor Treatments: Extending wear time between washes

These innovations have raised consumer expectations for performance while simultaneously improving comfort for all-day wear.

Sustainability Focus

Eco-conscious consumers are increasingly demanding sustainable options:

- 67% of consumers consider sustainability when purchasing activewear

- Recycled polyester (from plastic bottles) has seen 189% growth in activewear applications

- Brands with transparent sustainability practices report 28% higher customer loyalty

At HAVING, we've developed sustainable activewear lines that maintain performance while reducing environmental impact, helping our partners meet this growing consumer demand.

For a comprehensive overview of the entire activewear category, including manufacturing considerations and partnership opportunities, visit our Ultimate B2B Guide to Sourcing & Selling Activewear & Yoga Wear.

Who Is Buying Activewear & Yoga Wear?

Many businesses make the mistake of targeting too narrow a demographic. The activewear market has expanded well beyond traditional athletes to include diverse consumer segments with different needs and preferences.

Activewear appeals to multiple consumer segments: dedicated fitness enthusiasts (primarily 18-35), casual exercisers seeking comfort and style, wellness-focused individuals (particularly yoga practitioners), athleisure fashion adopters who may not exercise regularly, and increasingly, older adults (55+) focusing on health and comfort.

At HAVING, we've manufactured activewear for brands targeting various demographic segments. This experience has given us insight into the diverse consumer groups driving market growth:

Core Demographic Segments

Dedicated Fitness Enthusiasts

- Age: Primarily 18-35

- Characteristics: Regular exercisers, performance-focused, brand-conscious

- Motivations: Technical performance, durability, activity-specific features

- Shopping Behavior: Research-oriented, willing to invest in quality, loyal to brands that perform

This segment values technical features and performance benefits. They're willing to pay premium prices for products that deliver during intense workouts.

Casual Exercisers

- Age: Spans all age groups

- Characteristics: Moderate activity level, balance performance and style

- Motivations: Comfort, versatility, value for money

- Shopping Behavior: Influenced by style and comfort, moderate price sensitivity

This growing segment represents the largest market opportunity. They want activewear that performs adequately during light to moderate exercise but also looks good for everyday wear.

Yoga Practitioners

- Age: Primarily 25-55

- Characteristics: Wellness-focused, mindful consumers, often eco-conscious

- Motivations: Comfort during practice, sustainability, aesthetic alignment with yoga lifestyle

- Shopping Behavior: Value quality over quantity, brand loyal, influenced by instructor recommendations

This segment has specific needs including opacity during poses, non-restrictive waistbands, and soft fabrics that feel good during floor work.

Athleisure Fashion Adopters

- Age: Primarily 16-40

- Characteristics: Style-conscious, trend-aware, may not exercise regularly

- Motivations: Fashion appeal, comfort, social media influence

- Shopping Behavior: Trend-driven purchases, influenced by celebrities and influencers

This segment wears activewear primarily as fashion. They prioritize style and brand status over technical performance features.

Active Seniors

- Age: 55+

- Characteristics: Health-conscious, comfort-focused, growing interest in fitness

- Motivations: Comfort, ease of movement, quality construction

- Shopping Behavior: Value-oriented, loyal to brands that cater to their needs

This emerging segment represents a significant growth opportunity as the population ages and remains active longer.

Geographic Market Distribution

The activewear market shows significant regional variations:

| Region | Market Share | Growth Rate | Key Characteristics |

|---|---|---|---|

| North America | 38% | 5.8% | Early adopter market, athleisure-driven |

| Europe | 29% | 6.2% | Strong sustainability focus, premium positioning |

| Asia-Pacific | 24% | 8.5% | Fastest growing region, rising middle class |

| Rest of World | 9% | 5.2% | Emerging markets with significant potential |

Our manufacturing data at HAVING reflects these regional differences. European orders often emphasize sustainability and premium materials, while North American orders typically focus on innovation and performance features.

For detailed information on how to develop products tailored to these different consumer segments, explore our guide on Curating Your Collection: A B2B Guide to Activewear & Yoga Wear Styles, Functions & Material Options.

What Are the Key Market Trends Shaping the Future?

The activewear market continues to evolve rapidly. Businesses that fail to anticipate emerging trends risk being left behind as consumer preferences shift.

Emerging trends in the activewear market include increased demand for sustainable materials (recycled polyester, organic cotton), versatile crossover pieces that transition between activities, inclusive sizing and representation, technical innovations like anti-odor treatments and temperature regulation, and direct-to-consumer distribution models that challenge traditional retail.

At HAVING, we're constantly innovating to stay ahead of market trends. Here are the key developments we're seeing that will shape the future of this category:

Sustainability Integration

Sustainability has moved from niche concern to mainstream expectation:

- Recycled Materials: Recycled polyester from plastic bottles has become standard in many collections

- Organic and Natural Fibers: Growing demand for organic cotton and natural performance fibers

- Water Conservation: Waterless dyeing technologies gaining traction

- Circular Design: Products designed for longevity, repair, and eventual recycling

- Transparent Supply Chains: Consumers demanding visibility into manufacturing practices

Brands that authentically embrace sustainability are seeing stronger customer loyalty and willingness to pay premium prices.

Versatility and Crossover Design

The lines between activewear categories continue to blur:

- Work-to-Workout: Office-appropriate pieces with performance features

- Outdoor-Urban Crossover: Technical outdoor features in everyday styles

- Sleep-to-Street: Comfort-focused pieces that work for both lounging and casual wear

- Multi-Sport Functionality: Products designed to perform across multiple activities

This versatility trend aligns with consumers' desire for simplification and value—fewer, better pieces that serve multiple purposes.

Inclusive Sizing and Representation

The market is expanding to serve previously underrepresented consumers:

- Extended Size Ranges: Many brands now offer XXS-4XL or beyond

- Adaptive Activewear: Designs for people with disabilities

- Age-Inclusive Marketing: Representation of active seniors

- Gender-Neutral Options: Moving beyond traditional gender divisions

Brands embracing inclusivity are tapping into significant market segments that have been historically underserved.

Technical Innovation

Performance technology continues to advance:

- Biometric Monitoring: Integration with wearable technology

- Thermal Regulation: Fabrics that cool or warm based on body temperature

- Advanced Odor Control: Sustainable anti-odor treatments

- Compression Evolution: Targeted compression for specific muscle groups

- Ultra-Lightweight Construction: Maximum comfort with minimal weight

These innovations provide meaningful differentiation in an increasingly crowded market.

Distribution Channel Evolution

How activewear reaches consumers is changing dramatically:

- Direct-to-Consumer Growth: Brands bypassing traditional retail

- Social Commerce: Purchasing directly through social media platforms

- Subscription Models: Regular delivery of curated activewear

- Rental and Resale: Emerging circular economy models

- Experiential Retail: Stores offering classes, community, and experiences

Brands need omnichannel strategies that meet consumers where they prefer to shop.

For insights on how these trends affect manufacturing considerations and material selection, visit our detailed guide on Activewear & Yoga Wear Technology & Materials: A Buyer's Guide to Performance Fabrics, Construction & Durability.

What's the Competitive Landscape for Activewear & Yoga Wear?

Understanding the competitive environment is crucial for positioning your brand effectively. The activewear market has evolved from a few specialized brands to a diverse ecosystem of competitors.

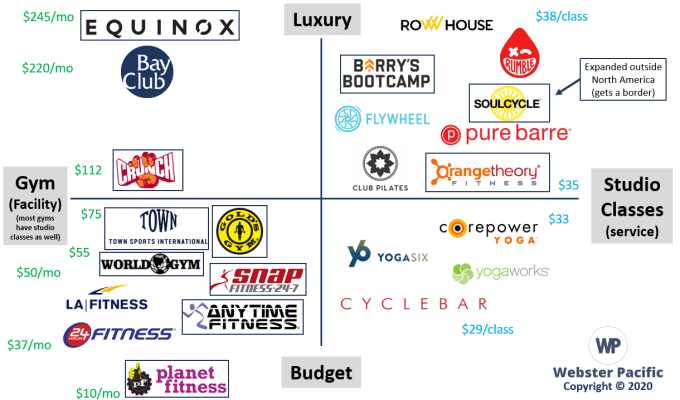

The activewear market has transformed from being dominated by traditional sports brands to include fashion retailers, specialty fitness brands, sustainable innovators, and direct-to-consumer disruptors. Competition is intensifying as the category grows, with differentiation occurring through technical features, sustainability credentials, price positioning, and specialized functionality.

At HAVING, we've manufactured for various players across this competitive landscape. This experience has given us insight into how different brands position themselves and compete for market share:

Market Segmentation by Brand Type

The activewear market includes several distinct competitor categories:

Traditional Sports Brands

- Characteristics: Established athletic heritage, broad product range

- Positioning: Performance credibility, technical innovation

- Advantages: Brand recognition, extensive distribution, R&D resources

- Challenges: Balancing performance and fashion, agility in responding to trends

These legacy brands leverage their athletic credibility but sometimes struggle to capture the fashion-forward athleisure consumer.

Fashion Retailers with Activewear Lines

- Characteristics: Fashion-first approach, trend-responsive

- Positioning: Style with adequate performance, accessibility

- Advantages: Existing customer base, fashion credibility, retail distribution

- Challenges: Establishing performance credibility, technical expertise

These brands excel at style and trend interpretation but may lack the technical expertise of specialized activewear manufacturers.

Specialty Fitness Brands

- Characteristics: Focus on specific activities (yoga, running, training)

- Positioning: Activity-specific expertise, community connection

- Advantages: Deep understanding of user needs, passionate customer base

- Challenges: Limited market size, expanding beyond core activity

These focused brands build loyal communities around specific activities but may struggle to expand their reach.

Sustainable/Ethical Focused Brands

- Characteristics: Strong emphasis on environmental and social impact

- Positioning: Conscious consumption, transparency

- Advantages: Appeal to values-driven consumers, differentiated story

- Challenges: Balancing sustainability with performance and price

This growing segment appeals to increasingly eco-conscious consumers willing to pay premium prices for sustainable options.

Direct-to-Consumer Disruptors

- Characteristics: Digital-first, often venture-backed

- Positioning: Value through supply chain efficiency, community building

- Advantages: Agility, customer data access, margin control

- Challenges: Customer acquisition costs, scaling challenges

These newer entrants are reshaping distribution models and often lead in digital innovation.

Competitive Differentiation Strategies

Brands differentiate themselves through several key factors:

Price Positioning

| Market Segment | Typical Retail Price (Leggings) | Value Proposition |

|---|---|---|

| Budget | $15-30 | Accessibility, basic functionality |

| Mid-Market | $30-70 | Balance of quality and value |

| Premium | $70-120 | Superior performance, durability |

| Luxury | $120+ | Premium materials, brand prestige |

Technical Differentiation

- Performance Features: Moisture-wicking, compression, odor control

- Construction Techniques: Seamless, bonded seams, strategic ventilation

- Proprietary Technologies: Branded fabric innovations, patented features

- Activity Specialization: Yoga-specific, running-focused, training-optimized

Brand Positioning

- Lifestyle Alignment: Connecting with specific consumer identities

- Community Building: Creating belonging through shared values

- Influencer Partnerships: Leveraging fitness professionals and celebrities

- Content Strategy: Providing workout guidance and lifestyle inspiration

For insights on how to position your brand effectively within this competitive landscape, explore our guide on Maximizing Your ROI: Activewear & Yoga Wear Wholesale Pricing, Retail Margins & Profitability Analysis.

What Are the Biggest Opportunities for B2B Buyers?

The evolving activewear market presents numerous opportunities for B2B buyers, but identifying the most promising areas requires market insight and strategic thinking.

Key opportunities for B2B buyers include entering underserved market segments (inclusive sizing, specific activities), developing specialized functional variants (outdoor crossover, recovery wear), creating more affordable sustainable options to expand market reach, and establishing subscription models for recurring revenue and customer retention.

At HAVING, we've helped numerous brands identify and capitalize on market opportunities. Based on our experience and market analysis, here are the most promising areas for B2B buyers to explore:

Underserved Market Segments

Several consumer segments remain underserved despite strong demand:

Inclusive Sizing

- Opportunity Size: Approximately 68% of American women wear size 14 or above

- Current Status: Limited options in extended sizes, particularly in technical activewear

- Key Requirements: Thoughtful fit considerations, inclusive marketing, extended size range

- Growth Potential: 15-18% annually

Brands that have expanded their size ranges have reported strong sales growth and customer loyalty.

Activity-Specific Niches

- Opportunity Size: Varies by activity, but specialized activities often lack tailored options

- Current Status: Many activities underserved by generic "workout wear"

- Key Requirements: Deep understanding of activity needs, technical solutions

- Growth Potential: 12-20% annually depending on niche

Examples include hiking-to-city crossover apparel, dance-specific activewear, and water sports.

Age-Appropriate Active Seniors

- Opportunity Size: Adults 55+ represent over 30% of the population in many Western markets

- Current Status: Limited options specifically designed for active aging bodies

- Key Requirements: Comfort, ease of movement, modest coverage, age-appropriate styling

- Growth Potential: 10-15% annually as population ages

This growing demographic has significant purchasing power but remains underserved by youth-focused brands.

Functional Innovation Opportunities

Developing products with specialized functionality offers significant growth potential:

Recovery Wear

- Market Status: Emerging category with limited mainstream options

- Consumer Need: Post-workout recovery enhancement

- Technical Requirements: Compression, infrared technology, comfort for extended wear

- Growth Projection: 18-22% annually

This category bridges activewear and wellness, appealing to performance-focused consumers.

Climate-Adaptive Activewear

- Market Status: Growing interest in all-weather performance

- Consumer Need: Versatility across temperature ranges

- Technical Requirements: Thermal regulation, layering systems, weather protection

- Growth Projection: 14-16% annually

Climate-adaptive features allow for year-round use, expanding the functional range of activewear.

Crossover Categories

- Market Status: Blurring lines between activewear and other categories

- Consumer Need: Versatility, multi-functionality

- Technical Requirements: Performance features in non-traditional activewear styles

- Growth Projection: 15-20% annually

Examples include office-appropriate performance wear, sleep-to-street comfort wear, and travel-optimized active pieces.

For guidance on developing products to capitalize on these opportunities, visit our comprehensive resource on Your Brand, Your Product: The Complete Guide to Private Label (OEM/ODM) Activewear & Yoga Wear Manufacturing.

Conclusion

The activewear and yoga wear market presents exceptional growth opportunities for B2B buyers who understand the evolving landscape. With continued expansion projected for years to come, strategic entry into this category can drive significant business growth.

At HAVING, we're committed to supporting your success in this dynamic market with our manufacturing expertise and market insights. Our industry-leading low MOQ of just 500 pieces makes private label activewear accessible to businesses of all sizes.

Frequently Asked Questions (FAQ)

What is the current size of the global activewear market?

The global activewear market is currently valued at approximately $370 billion and is projected to reach $547 billion by 2024, growing at a CAGR of 6.5%.

Which consumer segments are driving the most growth in activewear?

The fastest-growing segments include casual exercisers seeking athleisure styles, yoga practitioners, eco-conscious consumers demanding sustainable options, and increasingly, active seniors focusing on health and comfort.

How does the European activewear market differ from North America?

European consumers typically place higher emphasis on sustainability credentials, prefer more understated branding, and often favor premium quality over quantity. North American consumers tend to be early adopters of new trends and are more receptive to bold branding and technical innovation.

What price points perform best in the activewear market?

Mid-market products ($30-70 retail for leggings) currently capture the largest market share, but growth is occurring at both the premium ($70-120) and budget ($15-30) segments as the market diversifies.

How are direct-to-consumer brands affecting the activewear market?

DTC brands are reshaping consumer expectations around pricing transparency, creating more direct relationships with customers, and often leading in sustainability and inclusivity initiatives. Their success has forced traditional brands to adapt their business models.

What are the key barriers to consumer adoption of new activewear brands?

The primary barriers include established brand loyalty, uncertainty about quality and performance, fit concerns (particularly for online purchases), and price sensitivity in an increasingly competitive market.